- Details

- Blog

The Complete Binary Options Trading Guide

The Complete Binary Options Trading Guide

Binary options were introduced in 2008. What characterizes a binary option is its fixed payoff: if the option is in-the-money at expiration, it pays a predetermined amount; if it is out-of-the-money at expiration, it pays nothing. Binary options are also known as digital options, ‘all-or-nothing options,’ or Fixed Return Options (FROs) in the US (notably on the American Stock Exchange).

Payout rates are not fair for traders

Generally, the payout rates of binary options correspond to the popularity of their underlying instruments. For example, EUR/USD tends to offer better payout rates than less popular currency pairs. This is because popular assets attract more competition among brokers, which usually results in better returns for traders.

However, binary options typically offer much lower returns than they should. A fair return would be around 98%, considering the risk is 100%. In reality, binary options usually provide returns between 75% and 90%, making them unfair for traders.

- Details

- Cryptocurrency Trade Signals

Trading the Bitcoin Calendar Spread

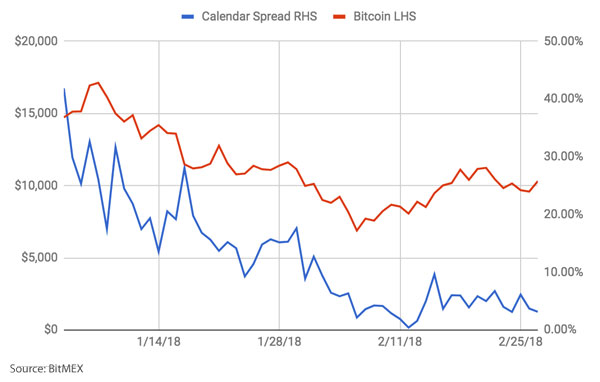

The calendar spread is a useful gauge of how bullish or bearish traders are in a forward starting-time period. In early February, Bitcoin lost close to 70% of its value measured against its December 2017 all-time high. The spread reached a low of 0.42% annualized during the same period.

The source for this analysis is BitMEX: ► BitMEX Crypto Exchange

Chart: March (XBTH18) and June (XBTM18) Bitcoin/USD contract spread

Source: BitMEX

The above chart shows the Bitcoin price and the annualized premium of the March (XBTH18) and June (XBTM18) Bitcoin/USD contract spread.

The calendar spread is calculated by the following function:

- Annualised Premium = [(XBTM18 Price - XBTH18 Price) / Bitcoin Spot] / 0.2493

- 0.2493 represents the annualized time value between the March and June expiry dates.

- Details

- Cryptocurrency Trade Signals

Bitcoin Trade Signal -February 2018

Bitcoin is trading at very crucial levels. BTC/USD trades at $9.250 near the key resistance levels $9.250-$9.500. If the Bitcoin/USD price manages to cross above $9.500 then we should expect a quick move to $10.200-$10.300

- Target-1: $9.480

- Target-2: $10.200-$10.300

- Target-3: $11.600-$11.800

Chart: Bitcoin/USD (H4)

► Compare Bitcoin Exchanges | ► How to Buy Bitcoin (Tutorial)

■ Bitcoin Trade Signal -February 2018

ExpertSignal.com

Forex Trading Signals

Discover free Forex trading signals for swing and long-term traders.

Cryptocurrency Trade Signals

Discover Mid-Term and Long-Term Cryptocurrency Trade Signals.