Standard Deviation (SD or 'σ')

◙ Primary Use: Measuring Market Volatility

◙ When Trading: Confirming Price Reversals

◙ Typical Settings: 20/21 Periods

![]() Introduction To Standard Deviation

Introduction To Standard Deviation

Standard deviation is a widely used statistical tool for measuring market volatility.

- Its symbol is the Greek letter sigma (σ).

Standard deviation is based on the concept of normal distribution, where values tend to cluster around a central average over time.

Understanding Standard Deviation

-

A higher standard deviation indicates greater variability in data values.

-

A lower standard deviation indicates less variability and more consistency around the mean.

![]() How to Calculate Standard Deviation

How to Calculate Standard Deviation

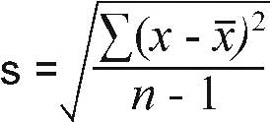

To calculate standard deviation:

-

Calculate the mean (average) of the data set.

-

Subtract the mean from each data point and square the result.

-

Sum all the squared deviations.

-

Divide the sum by the number of periods.

-

Take the square root of the result to get the standard deviation (σ).

![]() Trading with Standard Deviation

Trading with Standard Deviation

Standard deviation should not be used alone as a trading signal generator. Instead, use it to:

-

Forecast potential price reversals, based on the idea of mean reversion.

-

Confirm signals from other technical indicators, especially for price reversals.

-

Assess market risk and adjust your money management strategies accordingly.

![]() Platform Setup

Platform Setup

To add Standard Deviation in MetaTrader:

-

Navigate to: INDICATORS → TREND → STANDARD DEVIATION

-

Use the default or set to: Period: 20 or 21

Summary: Using Standard Deviation

Standard Deviation is a powerful technical analysis tool for gauging volatility and supporting trading decisions—especially when used with other technical indicators.

■ What is Standard Deviation?

ExpertSignal.com

Read More at ExpertSignal » Ichimoku

■ COMPARE PROVIDERS

► Forex Accounts

► Trade Signals

► Crypto Exchanges

► Volume indicators

► Oscillators

■ TREND INDICATORS

» Introduction

» Moving Averages

» Fibonacci