StrategyQuant Review: A Cutting-Edge Platform for Automated Strategy Development

StrategyQuant is a state-of-the-art platform designed for building and testing automated trading strategies—without requiring any programming skills.

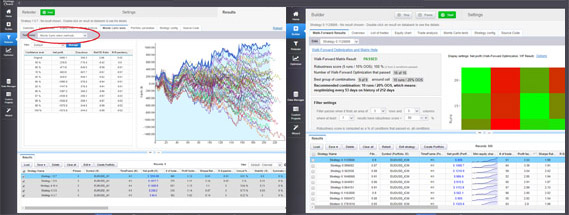

What sets StrategyQuant apart is its powerful capability to generate and evaluate hundreds of trading strategies simultaneously, using fully randomized market conditions. This helps traders identify robust and reliable strategies that can adapt to various market environments.

StrategyQuant Main Features

The platform can generate algorithmic strategies for trading Fx currencies, Stocks, Indices, ETFs, etc.

StrategyQuant offer two options:

(a) Build your automated strategy from scratch

(b) Find and modify a ready-to-use automated trading strategy

The finalized strategy can be exported and used for various platforms including MetaTrader-4:

(1) MetaTrader-4

(2) NinjaTrader

(3) TradeStation

► StrategyQuant Platform's Website

Key Features for Building Advanced Algorithmic Strategies

StrategyQuant offers a comprehensive set of features for creating and optimizing sophisticated trading algorithms:

-

Strategy Creation: Build automated trading strategies for any tradable financial asset across any chart timeframe.

-

Customization: Modify and fine-tune pre-built strategies to fit your trading goals and risk profile.

-

Indicator Variety: Access dozens of technical indicators, including support for Renko and Range chart types.

-

Advanced Backtesting: Conduct in-depth testing using Walk-Forward Analysis and Monte Carlo simulations to assess robustness.

-

Optimization Tools: Fine-tune your strategies with parameter optimization tools to enhance overall performance and adaptability.

StrategyQuant’s Entry/Exit types

□ Profit Target (PT)

□ Exit After X Bars

□ Move Stop Loss to Break-Even

□ Profit Trailing

□ Stop Trailing

□ Exit Rule (Operators + Price + Indicators, ...)

StrategyQuant -Ensuring the Robustness of Algo Trading Strategies

A curve-fitting strategy jeopardizes the efficiency of the machine learning process. StrategyQuant includes several features for ensuring the robustness of a great number of algorithmic strategies.

Defining Strategy Robustness

Robustness means an algorithmic strategy is able to cope with various market conditions, more specifically a trading strategy should:

(i) work on any data (unknown data)

(ii) work even without parameter re-optimization

(iii) not breaking apart when a number of trades are missing

(iv) not be dependent on any input parameters

StrategyQuant Randomizing Properties

These are some basic properties for randomizing market conditions:

-Randomizing Historical Data (ensuring the algorithmic strategy isn’t too dependent on certain historical data)

-Randomizing Strategy’s Parameters (testing the sensitivity of an algorithmic strategy to changes of some parameter values)

-Skipping Trades Randomly (randomly skipping some trades in order to evaluate the impact on the equity curve)

-Randomizing the Starting Bar

-Randomize the Order of Trades (examining the results of different Drawdowns)

StrategyQuant: Optimizing Algorithmic Trading Strategies

Every algorithmic trading system includes a set of parameters that influence how it behaves. These parameters may involve fixed constants, indicator periods, and various trading rules. Optimization is the process of testing different parameter values to determine which combination delivers the best performance for a specific asset or market condition. Common evaluation metrics include profitability ratios like the Return-to-Drawdown (Return/DD) ratio.

StrategyQuant enables users to optimize not only strategy parameters but also additional settings, such as trading hours, maximum trades per day, and more.

Walk-Forward Optimization

Walk-Forward Optimization is a robust method used to test the stability and adaptability of trading strategies under dynamic market conditions.

This process involves dividing historical data into several time segments. For each segment, the system undergoes:

-

Optimization Phase – Parameters are fine-tuned based on historical market data.

-

Forward Testing Phase – The strategy is then tested on future (unseen) data.

This sequence is repeated over multiple segments, helping identify parameter sets that are more likely to perform consistently in real-world trading environments.

Walk-Forward Matrix

The Walk-Forward Matrix aims to help algorithmic traders identify:

(i) The optimal period for optimizing their strategies

(ii) The best optimization frequency

StrategyQuant -Ranking Strategies Criteria

These are all Strategy’s Quant Ranking criteria, read them carefully as they are all very crucial for creating algorithmic strategies that work:

(1) Net Profit (Total profit/loss of any generated strategy) -IMPORTANT-

(2) Drawdown (measuring the decline from a historical peak)

(3) Max DD % (the maximum (%) drawdown of an algorithmic strategy) -IMPORTANT-

(4) % of Wins (measuring the percentage of winning trades)

(5) Annual % Return (measuring the average annual % return of the algorithmic strategy)

(6) Annual % Return / Max DD % (it is a ratio between annual percentage and maximum percentage drawdown) -IMPORTANT-

(7) Stagnation (Stagnation refers to the maximum number of days during which an algorithmic strategy doesn't make a new high on the balance of equity)

(8) Avg Profit (refers to the average profit in USD for the given period - Daily, Monthly, Yearly)

(9) Return/DD Ratio (measuring the profitability in relation to the maximum drawdown) -IMPORTANT-

(10) Expectancy {it is computed as: (percentage wins * average win) - (percentage losses * average loss) -by Van Tharp}

(11) R-Expectancy {computes the average profit value related to average risk (R) that you can expect from a system over many trades -by Van Tharp}

(12) R-Expectancy Score (R-Expectancy Score adds a score for trades frequency: R-Expectancy * AverageTradesPerYear)

(13) SQN (System Quality Number) (quality metrics developed by Van Tharp)

(14) Growth Stability (measures how stable is the growth of the equity chart of an algorithmic strategy)

(15) Win/Loss Ratio (measuring the ratio of winning trades against the losing trades)

(16) Average Win or Average Loss

(17) Average Bars in Trade (measuring the average number of bars the trade is open)

(18) Degrees of Freedom (relates to the number of criteria that are triggering the price action and determine entry points -the simpler the algorithmic strategy is, the more degrees of freedom it will show)

The 14-Day Trial

StrategyQuant is a commercial software platform; however, it offers a 14-day free trial, providing algorithmic traders with an excellent opportunity to explore its features and evaluate how the platform functions in real-world scenarios.

► StrategyQuant 14-day Free Trial

MORE ON ExpertSignal

■ COMPARE

» Cryptocurrency Accounts

» Expert Advisors

■ FOREX SIGNALS

» EA Builder

» StrategyQuant (Algo)

» 1000pip Climber System

» 1000Pip Builder

■ TUTORIALS

■ StrategyQuant Algorithmic Platform Review

ExpertSignal.com