Trading with the Ichimoku Kinko Hyo (一目均衡表)

◙ Primary Use: Evaluating the Trend | Identifying Overbought/Oversold Levels

◙ Trading with Ichimoku: Spotting Strong Trends and Reversals

◙ Standard Settings: Tenkan-Sen (9), Kijun-Sen (26), Senkou Span (52)

![]() Introduction to Ichimoku Kinko Hyo

Introduction to Ichimoku Kinko Hyo

Many Forex professionals consider the Ichimoku Kinko Hyo to be one of the best technical analysis tools for trading the Foreign Exchange Market. The Ichimoku Kinko Hyo was developed by the Japanese analyst Goichi Hosoda in the late 1960s. The indicator can be used in any financial market (Forex, stocks, etc.).

What distinguishes the Ichimoku Kinko Hyo from other indicators is its ability to provide a complete and quick picture of the current market conditions through the Quick Equilibrium Chart. Ichimoku Kinko Hyo can also identify strong trends and reversals at a glance.

Chart: Ichimoku Kinko Hyo on EUR/CAD

![]() Calculating the Ichimoku Kinko Hyo

Calculating the Ichimoku Kinko Hyo

The Ichimoku Kinko Hyo system contains 6 main elements. Here is how they are calculated:

■ Tenkan-Sen (転換線) Red Signal Line (9 periods)

-

Calculation: (Highest High + Lowest Low) / 2

-

Usage: Represents the minor support/resistance level

Trading Signals: If the red line moves up or down, the market is trending. If the red line moves horizontally, the market is ranging.

■ Kijun-Sen (基準線) Blue Signal Line (26 periods)

-

Calculation: (Highest High + Lowest Low) / 2

-

Usage: Acts as a support/resistance line and is used as a stop level

Trading Signals: If the current price is higher than the blue line, it signals an upward continuation. If the current price is lower than the blue line, it signals a downward continuation.

■ Chikou (遅行) Span / Green Span (26 periods backward)

-

Calculation: Compares the current price to the price 26 periods ago

-

Usage: Projects the current price back 26 periods on the chart to visualize the main trend. This serves as an additional tool

Trading Signals: If the Chikou Span crosses the current price from below, it signals upward movement. If it crosses from above, it signals downward movement.

■ Senkou (先行) Span / Brown or Yellow Leading Span A (26 periods)

-

Calculation: (Tenkan-Sen + Kijun-Sen) / 2

-

Usage: Forms part of the cloud indicating two levels of future support/resistance. It represents one edge of the Kumo.

Trading Signals: Indicates major support and resistance levels as follows:

i) If the current price is above the Senkou Span, the top line is the 1st support level and the bottom line is the 2nd support level.

ii) If the current price is below the Senkou Span, the bottom line is the 1st resistance level and the top line is the 2nd resistance level.

■ Senkou (先行) Span / Black Leading Span B

-

Calculation: (Highest High + Lowest Low) / 2

-

Periods: Calculated over 52 periods and plotted 26 periods ahead

-

Usage: Forms the second edge of the Kumo.

■ Kumo (雲) Cloud

-

Calculation: Formed by Senkou Span A and Senkou Span B

-

Usage: The space between the two spans (A and B) represents major support/resistance levels

-

Trading Signals:

If Senkou Span A is above Senkou Span B, it signals a Bullish Market.

-

If Senkou Span A is below Senkou Span B, it signals a Bearish Market.

-

A change in their relative positions signals a trend reversal.

-

![]() Trading with the Ichimoku Kinko Hyo Cloud

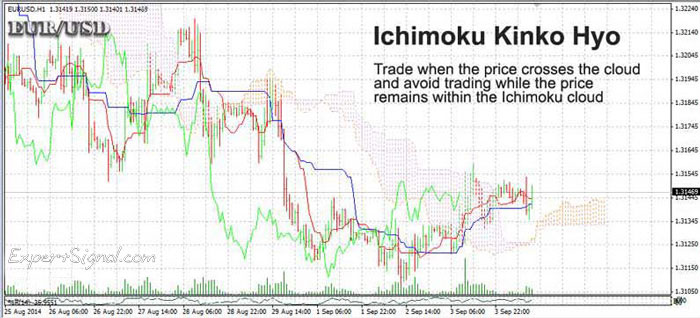

Trading with the Ichimoku Kinko Hyo Cloud

Here are some tips on how traders can use the Ichimoku Cloud:

(i) It is best to trade when the price of an asset crosses the Ichimoku Cloud, not while it remains within the Cloud.

(ii) Changes in the Ichimoku Cloud’s height indicate shifts in market volatility.

(iii) Thin clouds suggest weak support/resistance levels, while thick clouds suggest strong support/resistance levels.

![]() Platform Setup

Platform Setup

You can find and install 'Ichimoku Kinko Hyo' directly in MetaTrader-4 or MetaTrader-5:

□ GO TO → INDICATORS → TREND → ICHIMOKU KINKO HYO

□ SETTINGS → TENKAN-SEN (9), KIJUN-SEN (26), SENKOU-SPAN (52)

■ Trading with the Ichimoku Kinko Hyo

ExpertSignal.com (c)

Read More at ExpertSignal » Ichimoku

■ COMPARE PROVIDERS

► Forex Accounts

► Trade Signals

► Crypto Exchanges

► Volume indicators

► Oscillators

■ TREND INDICATORS

» Introduction

» Moving Averages

» Fibonacci